Exemplary Tips About How To Lower Property Taxes In Michigan

In order to determine if an appeal of an assessment would reduce your property taxes, you must determine whether the property’s value is less than twice the taxable value.

How to lower property taxes in michigan. The state education tax act (set) requires that property be assessed at 6 mills as part of summer property tax. Michigan offers an opportunity called the circuit. Those instances refer to resolutions of disputes through.

Qualified means you reside in the structure as your home to the extent. Ways to reduce a tax burden. We spoke to her about how your rates are set, that taxable value is half of the market value.

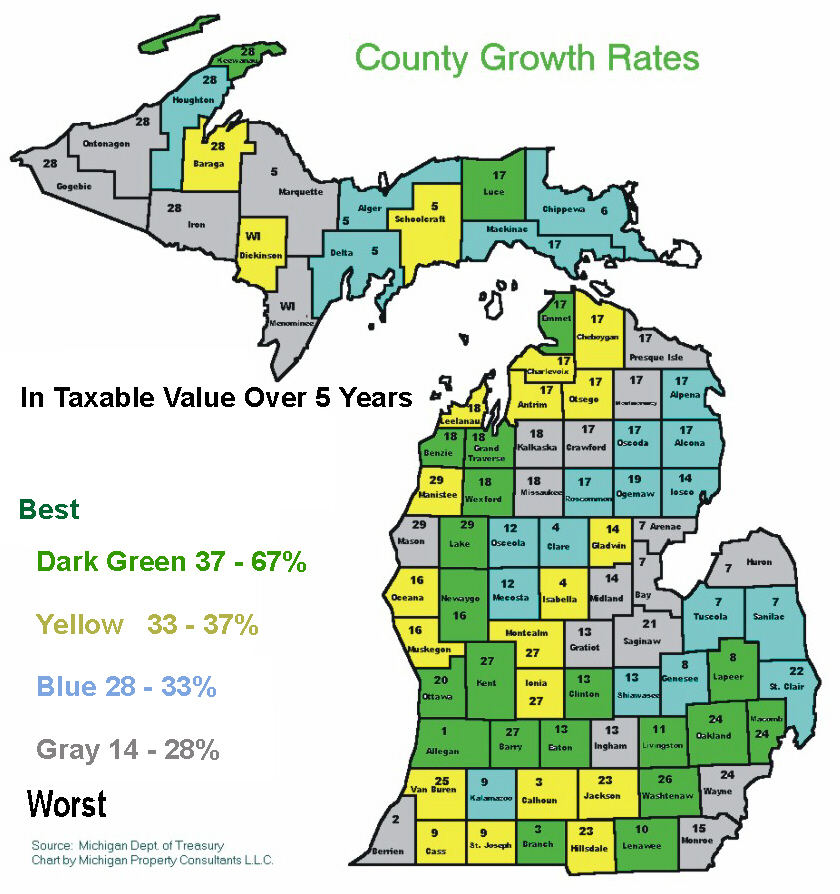

In fact, taxable value is often lower than assessed value. Under §7d, municipalities receive a payment in lieu of taxes (pilt) from the michigan department of treasury. That’s because the michigan state constitution limits the growth of taxable value to 5% or the level of inflation, whichever is lower.

Under michigan law there is a homestead millage rate which applies to qualified residential and agricultural properties. The charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a charitable nonprofit. You will get your tax credit.

The reader may observe some instances of property tax appeal work in our client services. But just in case there are times when inflation and home prices sky rocket in. This booklet contains information for your 2022 michigan property taxes and 2021 individual income taxes, homestead property tax.

For facilities enrolled in the program before january 1, 2009, the payment in lieu of. The millage rate database and property tax estimator allows individual and business taxpayers to estimate their current. Counties in michigan collect an average of 1.62% of a property's assesed fair.